Peter Lynch Net Worth - A Visionary Investor's Journey

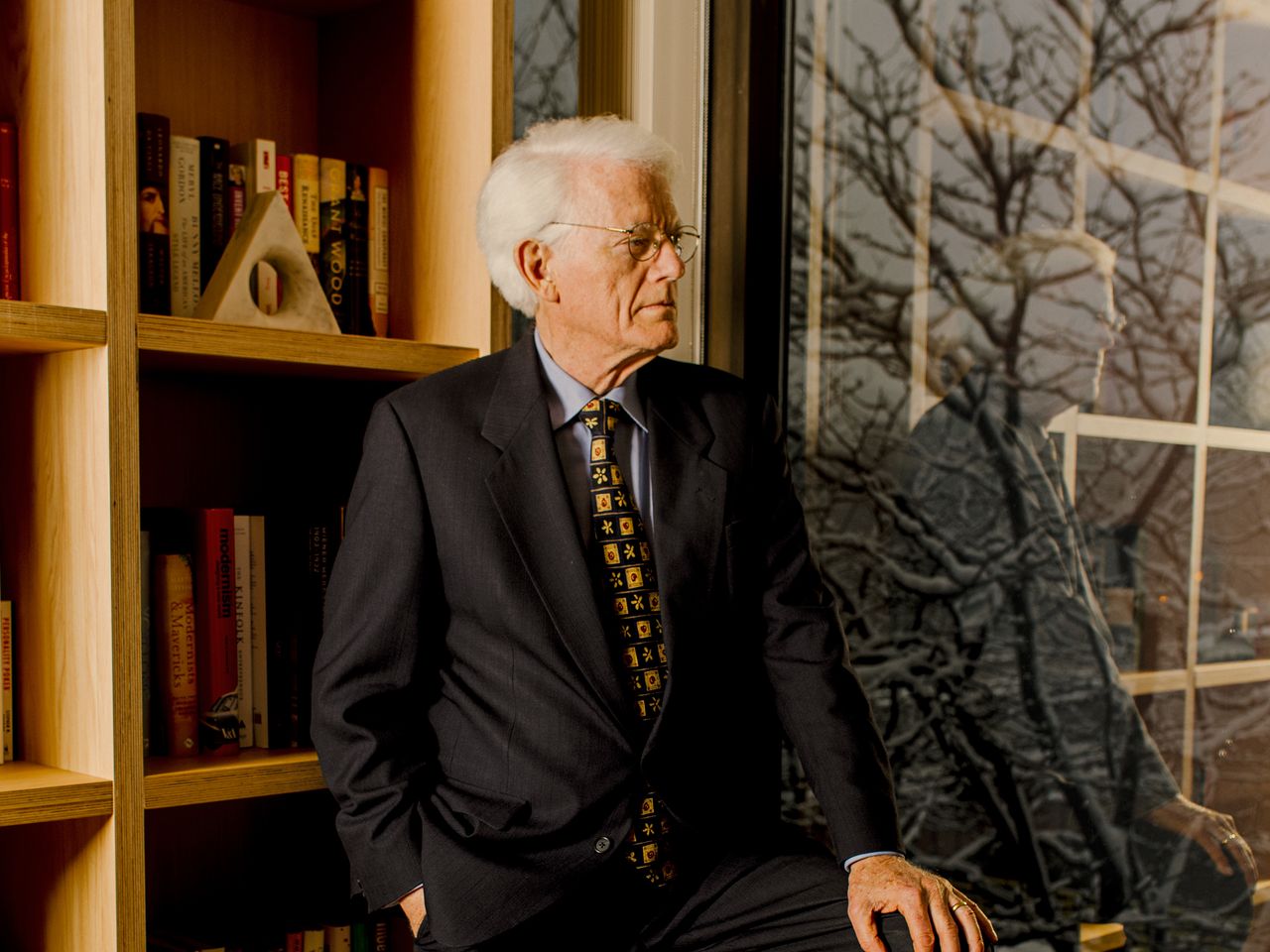

Would like to get to know more about Peter Lynch net worth? Then you are in the right place. Peter Lynch is an American investor who achieved legendary status in the world of finance due to his exceptional investment acumen and remarkable success during his tenure as a fund manager.

Author:Alex MercerReviewer:Nathanial BlackwoodSep 19, 202328.5K Shares445.6K Views

Would like to get to know more about Peter Lynch net worth? Then you are in the right place. Peter Lynch is an American investor who achieved legendary status in the world of finance due to his exceptional investment acumen and remarkable success during his tenure as a fund manager.

Born on January 19, 1944, in Newton, Massachusetts, Lynch became widely known for his work as the manager of the Fidelity Magellan Fund, which he steered to unprecedented heights during his illustrious career. This article delves into the life and achievements of Peter Lynch, exploring his early years, investment career, personal life, and net worth.

Quick Facts

| Name: | Peter Lynch |

| Date of Birth: | Jan 19, 1944 |

| Place of Birth: | Newton, Massachusetts, U.S. |

| Net Worth: | $450 Million |

Early Life And Education

Growing up in the suburbs of Newton, Massachusetts, Peter Lynch displayed an early passion for numbers and analytical thinking. As a young boy, he would often be seen engrossed in financial newspapers and magazines, curious about the workings of the financial world. This innate curiosity about markets and investments laid the foundation for his future endeavors.

After completing his high school education, Lynch pursued a degree in Finance at Boston College. During his time at the college, he immersed himself in the study of financial markets, economic principles, and investment strategies. Lynch's academic pursuits sharpened his analytical skills and honed his ability to assess investment opportunities critically.

His enthusiasm for finance drove him to pursue further education, and he earned a Master of Business Administration (MBA) from the prestigious Wharton School of the University of Pennsylvania. The knowledge and insights gained during his time at Wharton proved instrumental in shaping Lynch's investment philosophy.

Investment Career

Peter Lynch's investment journey commenced in 1969 when he joined Fidelity Investments as an intern. His dedication and aptitude for financial analysis quickly garnered attention, leading Fidelity to offer him a full-time position after completing his MBA. This marked the beginning of Lynch's long and fruitful association with the company.

In 1977, Lynch was entrusted with managing the Fidelity Magellan Fund, a relatively modest mutual fund at the time. Under his astute leadership, the fund's assets grew exponentially, transforming it into the largest and most successful mutual fund globally. Lynch's investment approach was centered around in-depth research and a profound understanding of the companies he invested in.

A key tenet of Lynch's philosophy was the "buy what you know" strategy, which advocated investing in companies whose products or services one was familiar with in everyday life. This approach allowed individual investors to leverage their personal experiences to identify potentially successful companies. Lynch's ability to spot such opportunities early on and hold onto them as they grew made him a revered figure in the investment community.

During his tenure as the manager of the Magellan Fund, Lynch made several groundbreaking investments, including successful bets on companies like Walmart, McDonald's, and Coca-Cola, to name a few. His investment choices were guided by a focus on companies with robust fundamentals, high growth potential, and a competitive edge in their industries.

In 1990, after achieving unprecedented success at the Magellan Fund, Lynch decided to step down as its manager. Nevertheless, he continued to contribute to Fidelity as a vice-chairman and senior portfolio manager for a few more years before eventually retiring from active fund management.

Peter Lynch Wife

Lynch wed Carolyn Ann Hoff, who later became a partner in establishing the Lynch Foundation. Carolyn passed away in October 2015 at the age of 69 from complications related to her illness. She was an American philanthropist and a contract bridge world champion who won many international titles and a gold medal.

Throughout his career, Peter Lynch found unwavering support and stability in his wife, Carolyn Lynch. Carolyn played a significant role in Lynch's life, providing constant encouragement and understanding as he navigated the often tumultuous waters of the financial world. Their enduring partnership and mutual respect have been a bedrock of strength for Lynch throughout his professional journey.

Peter Lynch Kids

Peter and Carolyn Lynch were blessed with three children – all girls. While information regarding their children's names and personal lives remains largely private, it is evident that Lynch's family has been an essential source of love and support, further reinforcing his strong grounding in the face of success.

Impact On Investment Culture

Peter Lynch's investment success not only made him a household name but also had a profound impact on the investment culture at large. His approachable and down-to-earth investment philosophy resonated with individual investors, encouraging them to take an active interest in managing their own portfolios. Unlike many Wall Street figures who seemed inaccessible to the average person, Lynch made investing feel approachable and achievable.

One of the most significant contributions of the "Peter Lynch Effect" was the rise of DIY (Do-It-Yourself) investing among retail investors. Lynch's emphasis on fundamental research and investing in what one knows empowered individuals to take charge of their financial destinies. As a result, many investors began to research and analyze companies, seeking to invest in businesses they genuinely understood and believed in.

Moreover, Lynch's long-term and patient investment approach debunked the myth of quick riches through day trading and market timing. He highlighted the importance of staying committed to one's investment thesis and resisting the urge to make impulsive decisions based on short-term market movements. This shift in mindset instilled a sense of discipline and rationality among investors, fostering a more stable and informed investment environment.

The "Peter Lynch Effect" also played a role in reshaping the financial industry itself. Fund managers and financial advisors began incorporating Lynch's principles into their own strategies, recognizing the value of focusing on long-term growth and investing in well-researched opportunities. As a result, more investment professionals started placing an emphasis on educating their clients and fostering transparent, long-term relationships.

Authorship And Educational Contributions

Following his retirement from active fund management, Peter Lynch turned his attention to sharing his investment insights and experiences with a wider audience. He authored several best-selling books, including "One Up On Wall Street," "Beating the Street," and "Learn to Earn." These books became invaluable resources for investors seeking to understand Lynch's investment philosophy and learn from his successes and mistakes.

Through his books, Lynch demystified complex financial concepts and made investing more accessible to the general public. He used relatable language and real-world examples to explain investment principles, enabling readers to feel more confident and informed about making their own financial decisions. His ability to communicate financial concepts effectively earned him a reputation as an excellent educator in the world of finance.

Furthermore, Lynch's educational contributions extended beyond his books. He became a sought-after speaker at investment conferences, seminars, and educational events. His presentations offered valuable insights into his investment approach and shared practical advice for investors of all levels of experience. His willingness to share his knowledge and experiences further solidified his status as a mentor and teacher to aspiring investors and finance enthusiasts.

Philanthropy And Giving Back

Despite his immense success, Peter Lynch never lost sight of the importance of giving back to society. Along with his wife, Carolyn, Lynch has been actively involved in philanthropic endeavors, supporting various charitable causes. Their philanthropy spans areas such as education, healthcare, and social welfare.

Education was a cause particularly close to Lynch's heart. He donated substantial sums to educational institutions, including his alma mater, Boston College, where he also served as a trustee. His contributions have enabled countless students to access quality education and pursue their dreams.

Additionally, Lynch supported medical research initiatives, especially those focused on finding cures and treatments for diseases that affect children. His philanthropic efforts in the healthcare sector have made a significant impact on improving the lives of many.

Moreover, Lynch and Carolyn have been involved in community development programs that aim to uplift underprivileged communities and provide essential resources to those in need. Their philanthropic work embodies their commitment to creating a positive and lasting change in society beyond the realm of finance.

Reflections On A Storied Career

Looking back on his storied career, Peter Lynch's humility remains a defining trait. Despite achieving unparalleled success, he remains modest and acknowledges that investing involves both successes and failures. Lynch often emphasizes that the key to success lies in learning from mistakes and maintaining discipline in the face of market fluctuations.

As an elder statesman of finance, Lynch's reflections on the ever-evolving investment landscape are highly valued. His experiences spanning multiple market cycles offer a unique perspective, and his willingness to share both triumphs and challenges has resonated with investors worldwide.

Lynch's advice to investors often revolves around the importance of staying true to one's investment philosophy and not succumbing to short-term market noise. He reminds investors that a long-term approach, anchored in thorough research and a belief in the underlying value of the companies they invest in, can withstand market volatility and lead to success over time.

Peter Lynch's Net Worth

Peter Lynch is a $450 million net worth American investor and mutual fund manager. Peter estimated his net worth at $352 million in 2006. According to the New York Times, Boston Magazine declared him the 33rd richest resident in Boston.

He has donated tens of millions of dollars, maybe up to $100 million, to numerous causes. Between 1977 and 1990, Peter managed the Magellan Fund for Fidelity Investments, averaging an astounding 29.2% yearly return. During his leadership, the fund saw historic growth and became the world's best-performing mutual fund.

Under Peter's leadership, assets under management increased from $18 million to $14 billion. Peter Lynch has co-authored a number of investment books and papers. "Ten bagger" and "invest in what you know" are terms he invented.

People Also Ask

Who Were Peter Lynch's Most Successful Investment Picks?

Walmart, McDonald's, and Coca-Cola were some of Peter Lynch's most successful investment picks.

What Is Peter Lynch's Investment Philosophy?

Peter Lynch's investment philosophy emphasized thorough research, "buy what you know," and a focus on companies with strong fundamentals and growth potential.

How Did Peter Lynch Achieve Such Remarkable Success As A Fund Manager?

Peter Lynch achieved remarkable success as a fund manager through disciplined research, a long-term investment approach, and the ability to identify promising companies early on.

Final Words

We hope you learned more about Peter Lynch's net worth. Peter Lynch's legacy as one of the most successful investors in history continues to inspire and guide aspiring investors worldwide.

His approach to investing, emphasizing research, patience, and a strong understanding of the companies he invested in, set the benchmark for sound investment strategies. Lynch's journey from a young finance enthusiast to a Wall Street icon serves as a testament to the power of dedication, knowledge, and a strong belief in one's abilities.

Alex Mercer

Author

Alex Mercer is a seasoned author and analyst specializing in wealth research, with a keen focus on evaluating the net worth of individuals across various industries. With over a decade of experience in financial analysis and wealth assessment, Alex has developed a nuanced understanding of the factors that contribute to an individual's financial status, from investments and assets to market trends and economic policies. His work involves in-depth reviews and analyses, providing insightful observations on wealth accumulation, management strategies, and the socio-economic implications of wealth distribution.

Throughout his career, Alex has become known for his ability to distill complex financial data into understandable and engaging narratives, making the subject of wealth and net worth accessible to a broad audience. His expertise is not just in numbers but in telling the stories behind them, highlighting the journeys, strategies, and decisions that lead to financial success or challenges. Alex's contributions to the field of wealth research are valuable resources for anyone looking to understand the dynamics of wealth in today's world, offering a unique perspective that bridges the gap between financial analysis and human interest.

Nathanial Blackwood

Reviewer

Nathanial (Nate) Blackwood is a distinguished financial journalist with a decade of experience in net worth analysis. He holds an Economics degree from the University of Finance and a Data Analysis certification, enabling him to blend thorough insights with engaging storytelling. Nate is known for making complex financial information accessible to a wide audience, earning acclaim for his precise and reader-friendly analyses. Beyond his writing, Nate is dedicated to financial literacy, actively participating in educational forums and workshops.

He is the founder of PureNetWealth, a platform that demystifies the financial achievements of public figures by exploring the strategies and decisions behind their fortunes. Nate's work bridges the gap between intricate economic concepts and the general public, inspiring a deeper understanding of wealth dynamics. Follow Nathanial Blackwood for essential insights into the financial narratives shaping our world.

Latest Articles

Popular Articles