What Is The Best Alternative For Americanexpress.Com Selectemail And How Can We Apply

Anyone with an American Express card can place orders on the company's website or contact americanexpress.com selectemail. If you're unsure about anything, this site contains a wealth of information.

Mar 26, 202210 Shares357 Views

For people who travel worldwide, the American Express card is the preferred method of payment. The card has a number of perks, including no international transaction fees and free insurance coverage. This credit card is ideal for travelers who don't want to take out a loan or deal with the hassles of overseas payments.

The AmericanExpress Confirm card is a credit card for which you may apply and get authorized with only a few mouse clicks. It's the perfect card for people who want to make transactions quickly and easily.

Anyone with an American Express card can place orders on the company's website or contact americanexpress.com selectemail. If you're unsure about anything, this site contains a wealth of information.

American Express Credit Card Types

There are several American Express credit cards to select from, each with a different value and purpose. In comparison to cards with other benefits like business or no annual charge, Gold, Platinum, and Infinite Points cards provide a higher degree of luxury or incentives.

Customers that need to choose between a set number of two-time offers, three-time offers, and four-time offers are issued American Express Membership Offers.

The buyer is then able to choose the package that best suits his or her needs. Discounts on purchases, unique agreements with businesses, and events are all possible offers.

Expanding on this, here are some of the cards we've listed with their features:

The Platinum Card

Customers who use the American Express Platinum Card to win 60,000 Membership Rewards Points will be eligible for a $5,250 annual fee if they make a $5,000 or more transaction during the first three months of card membership.

Blue Cash Everyday Card

Consumers may get a $1000 cashback credit with the Blue Cash Everyday Card, which has no annual charge. When consumers add purchases to their monthly statement credit within the first three months of card use, they can earn up to $0 cashback.

American Express Gold Card

A new American Express Gold Card has been announced, and it offers customers 50,000 Membership Rewards Points once they spend $2,000 on their card during the first three months. A $250 annual fee is also required.

American Express Cash Magnet Card

Some of your purchases are put on a credit card that you may use for online purchases when you apply for the American Express Cash Magnet Card. Because there is no yearly charge, it is mostly a one-time setup expense. You may put up to $200 worth of purchases on the card at once, which is normally issued as a statement credit.

Amex Everyday Credit Card

Users can earn incredible points with a $0 balance transfer fee and an additional 15,000 membership rewards points after making a $1,000 transaction with their card within the first quarter of use. Users can open it with no money in their account, but they must request a sixty-day account opening. There is no need to pay an annual fee.

American Express Best Card

Blue Cash Preferred Card: Spend $3,000 on your new card during the first 6 months and receive a $300 statement credit. For the first year, there is no yearly cost; after that, it is $95. Purchase Now and Pay Later: There are no upfront plan costs when you use Plan It to divide large purchases into monthly installments. Plan costs are waived for the first 12 months after your account is opened. After that, based on the plan length, the APR that would otherwise apply to the purchase, and other considerations, a monthly plan charge of up to 1.33 percent of each purchase amount will be transferred into a plan.

Amex Everyday Credit Card: The major advantage of the American Express EveryDay Credit Card, which has no annual fee, is that cardholders can get a 20% bonus on all points earned if they make at least 20 purchases within the billing cycle. This card is a good alternative for people who wish to dip their toes into the Membership Rewards-earning card pool without paying an annual fee.

American Express Amex

Amex is a popular travel credit card. Amex is a globally used credit card. It has a wide selection of items to meet the demands of its clients.

It offers a wide range of Amex credit cards for travelers, including travel rewards cards and business cards. Each product has benefits and drawbacks, which are detailed below.

Blue Delta SkyMiles Credit Card: This card gives 1000 bonus points for your first purchase and another 1000 for signing up. No yearly charge means you receive a higher return on your money.

Gold Delta SkyMiles: The credit card was created for regular travelers, and it allows users to earn 35,000 points after their first $1,000 transaction. The card is $95 for the first year and $175 after that.

Platinum Delta Skymiles credit card:This credit card has a novel, one-of-a-kind offer: spend $1,000 on travel and earn 5,000 Medallion Qualification Miles and 35,000 Bonus Miles. Delta Airlines Medallion Qualification Miles can be used for Delta Airlines flights or transferred to other World Elite members.

Delta Reserve Credit Card:Customers who spend $3,000 on a new card during the first three months get 10,000 Medallion Qualification Miles and 40,000 Bonus Miles. The cost is $450 per year.

Hilton Honors Card:The Hilton Honors Card comes with no annual fee and a unique benefit that is only available for a short period of time. After spending $1,000 on purchases with their card membership in the first three months, customers can receive 100,000 Hilton Honors Bonus Points.

Hilton Honors American Express Ascend Card:If you spend $1,000 on the Hilton Honors American Express Ascend Card by February 28th, you may receive 100,000 Hilton Honors Bonus Points.

This card will not only provide you with a lot of points for free flights and rooms at CBR hotels across the world, but it will also cost you only $95.

American Express Apply Credit Card

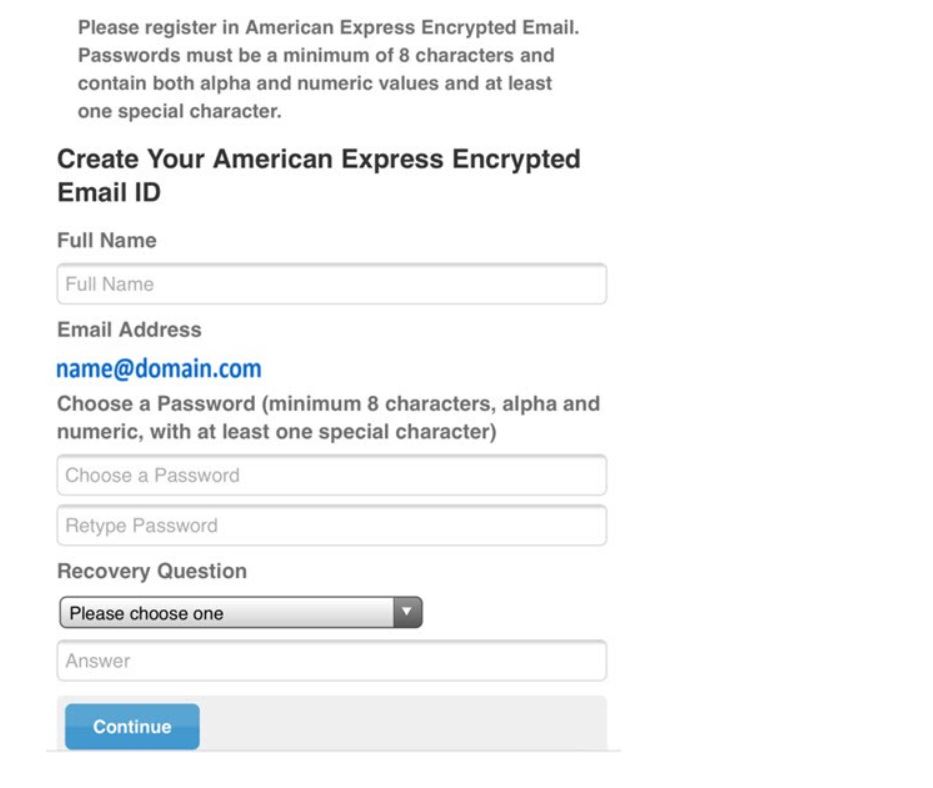

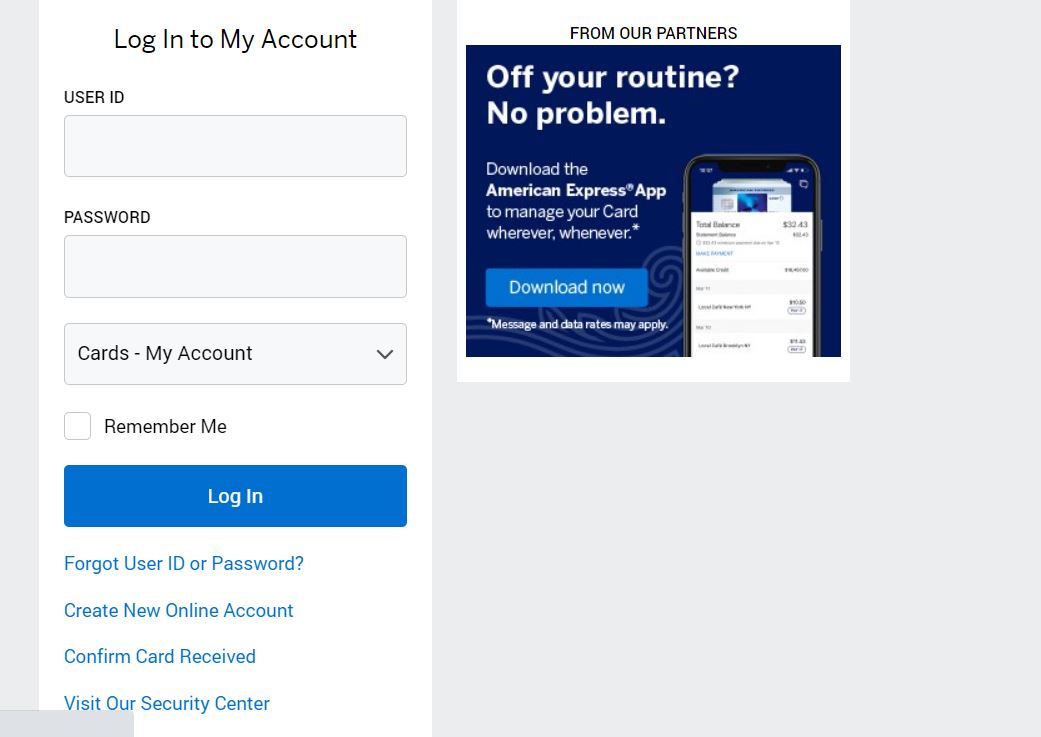

An American Express credit card can be applied for via mail or online at Amex's website. A prequalification tool is available on the site to assist you to figure out which card you're most likely to be approved for. Not every person who gets a pre-qualification offer is going to be given a credit card.

Amex will ask you for personal information such as your name, Social Security number, address, and more when you fill out an application. Your employment details, as well as additional sources of income, may be requested. If you are under the age of 18, you will not be accepted for your own account, and if you are over the age of 18, you must present proof of independent income or have a qualified cosigner.

American Express Pre Approval

It's important to understand that being prequalified isn't the same as being preapproved. It's not unusual to receive a preapproval offer for a card from an institution with whom you already have a credit card or other financial relationship. Based on what they perceive to be responsible payment behavior, the bank presents an offer for a new card.

A pre-qualified offer is one that a customer requests to determine their chances of being accepted for a certain credit card. Consumers may use a tool on the American Express website to locate pre-qualified deals. The majority of prequalification programs do a mild credit inquiry, which will not harm your credit score. This makes features like this one a wonderful way to boost your confidence in your ability to get approved for some cards—or to help you realize when your application might need more work for others.

American Express Rewards

With many American Express cards, every transaction earns you Membership Rewards points. AmEx's distinctive green, gold, and platinum cards are among the cards that earn points.

You'll get at least one point for every dollar you spend on your card. Depending on the card, you may be able to earn bonus points for certain transactions, such as 3 points per dollar spent at restaurants or 5 points per dollar spent on certain travel expenditures. Additional offers for new cards targeted "Amex Offers" that give you bonus points for purchasing at certain merchants, and other incentives can all help you earn more points. These points may be used for a variety of things, including trip reservations, credit card charges, online purchases, gift cards, and more.

If you're unfamiliar with the issuer or travel rewards and redemptions, American Express might be overwhelming to unpack. However, with excellent customer service and one of the largest credit card portfolios available, it's a reasonable choice to consider if you're searching for a new card, especially if you're planning a trip.

Whether you want cashback, Membership Rewards, or miles toward your favorite airline, your American Express card can help you achieve your goals. Before you apply for an americanexpress.com selectemail credit card, think about your own spending and credit card needs to make sure you choose the best option for you in the long run.

How Do I Use My American Express Reward Points?

Sign up for online services to see your qualified purchases and redeem them. You may also use the American Express App to browse and redeem qualifying purchases. Only purchases that are qualified for redemption have been deposited into your card account.

What Is The Minimum Credit Score For American Express?

Depending on the card, an American Express credit score of 700 or more is required. Those who have good to great credit can apply for an American Express credit card.

Conclusion

If you're unfamiliar with the issuer or travel rewards and redemptions, American Express might be overwhelming to unpack. However, with excellent customer service and one of the largest credit card portfolios available, it's a reasonable choice to consider if you're searching for a new card, especially if you're planning a trip.

Whether you want cashback, Membership Rewards, or miles toward your favorite airline, your American Express card can help you achieve your goals. Before you apply for an americanexpress.com selectemail credit card, think about your own spending and credit card needs to make sure you choose the best option for you in the long run.

Latest Articles

Popular Articles